A Few Things About Accounting Periods In NetSuite OpenAir You Should Know

Using accounting dates and accounting periods in NetSuite OpenAir

NetSuite OpenAir transactions have many dates such as create date, updated date, approved date, submitted date, and more. None of these dates, however, may align with your accounting system’s accounting periods or dates. NetSuite OpenAir supports the ability to introduce another set of dates called accounting date on many transactions such as timesheets, expense reports, invoices, and revenue recognition. For example, an invoice can receive an accounting date once it has been approved. A revenue transaction can receive an accounting date when it was created.

Accounting systems inherently have the concept of accounting periods, and a period is either open or closed, with only one period being allowed to be open at any given time. This drives the accounting date and leads to the reconciliation needs by accounting date between NetSuite OpenAir and your accounting system. NetSuite OpenAir also has the concept of accounting periods as a way to define how accounting dates are set. Need to have regional control of which accounting period is active? NetSuite OpenAir can accommodate that as well.

By using accounting dates and accounting periods in NetSuite OpenAir, financial-based reports can be defined indexing into the data by accounting date and therefore support the reconciliation of NetSuite OpenAir data to your accounting system.

How

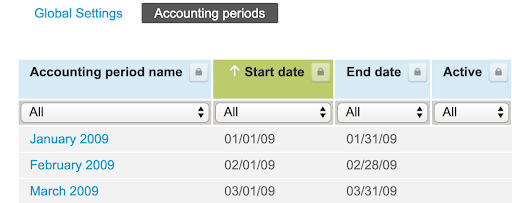

Accounting periods are used to define a finite period of time for financial transactions. For example, an accounting period is defined by a start and end date but applies a single date to the transaction accounting date when used.

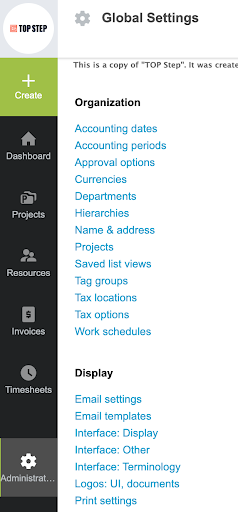

To set up accounting periods, navigate to Administration → Global Settings → Accounting Periods

1. Create the monthly periods for the year, with defined start and end dates.

2. Select a date that represents the period. This single date will be set on the accounting date field of transactions. The midpoint of the period is a good practice unless the end date or start date aligns with other accounting practices more accurately.

3. For each period use the checkboxes to define if the period is active and if it is the current and/or default period.

-

- [Current accounting period] is an option available on billing and recognition rules. Whichever accounting period is set as the current period, the associated date will be inherited by all billing and revenue transactions.

- The default accounting period is useful for accounting date controls.

4. Default and current accounting periods must be manually updated and is usually a part of the month-end close process.

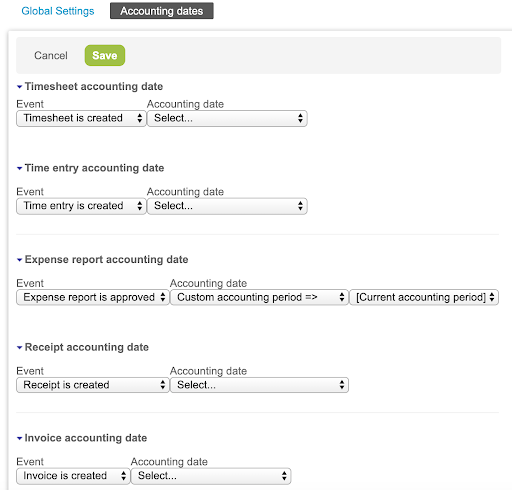

Accounting Dates are the fields on transactions such as time entry, timesheet, invoice, and more but the automated setting of these date fields is controlled by the Accounting Date setup in the Administration module. Without defining the trigger or action that will automatically set an accounting date on transactions, other than billing and revenue rules that may rely on accounting period definitions, the accounting date of transactions will default to blank.

Use the drop-downs to indicate the event and the date you would like to attribute to the event.

- For example, timesheet accounting dates may be defined by the date that the timesheet was submitted or the date it was approved, etc. Based on month definitions it is important to know how the accounting dates will be set in order to understand how revenue and billing is aligned to each month within the year.

- The date applied to a transaction based on the trigger, such as approval, may use the current or default accounting period setting.

For companies that require the ability for regional control of the accounting period, a ‘Current Period’ functionality exists. This allows the definition of a named current period that points to the Accounting Period list for its current value.

Example: UK Current Period could point to May 2020 as the current period while Canada Current Period could point to June 2020. Rule configuration would use the named current period of UK Current Period or Canada Current Period instead of the default value [current accounting period].

To enable the current accounting period functionality, contact NetSuite OpenAir support.

A word of caution

Accounting periods must be manually updated to define the current period for accurate reporting.