Capturing VAT in NetSuite OpenAir

From Wikipedia: A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to and is often compared with a sales tax.

VAT essentially compensates for the shared service and infrastructure provided in a certain locality by a state and funded by its taxpayers that were used in the provision of that product or service. Not all localities require VAT to be charged, and exports are often exempt.

OpenAir customers need a way to reimburse VAT (GST) taxes to their employees, report on VAT and not rebill VAT amounts to their clients.

OpenAir tax options does this nicely.

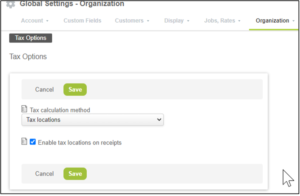

First, set the tax options under Organization to Locations and check the box to enable on receipts.

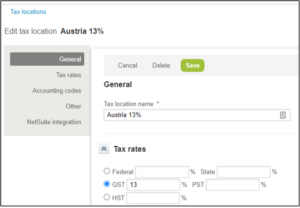

After Save, you can set up tax locations as needed.

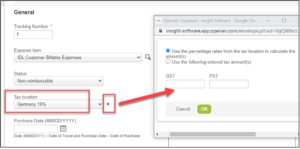

On Expense receipts, employee can choose a Tax Location. The VAT can be calculated based on the percentage or can be manually set.

Lastly, on Expense billing rules, you can set the checkbox to Subtract GST/HST from the receipt.