Remove The Challenges Of Adhering To The Customer’s Expense Policy In NetSuite OpenAir

Your company has an expense policy that your employees must follow in order to be reimbursed for out of pocket expenses. Sometimes a customer may require you to follow their expense policy instead. The challenge is how to communicate to your project and invoicing teams the specifics of the customer policy for accurate invoicing.

NetSuite OpenAir has an expense policy feature that allows you to display specific elements of the customer’s expense policy to consultants as they enter their expense receipts and to the invoicing staff when they generate invoices for those incurred expenses.

How

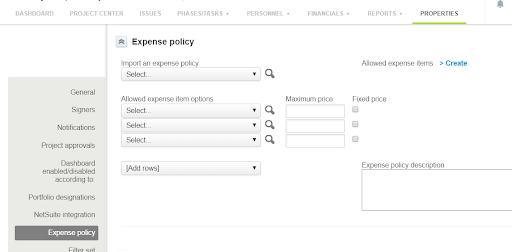

The Expense Policy feature is an internal switch and must be activated by NetSuite OpenAir support. When enabled, a new section appears within the Project Properties page:

Expense policies can be copied from other projects, as would be the case in a single customer having multiple projects. Expense policies, in general, have three main parts:

- Allowed expense items: limit the types of expense items allowed against this project

- Maximum price options: define any receipt amount limits. Billing rules can also cap the billing of an expense item to a customer but the expense policy feature limits how much the consultant can record on the receipt.

- Description: perhaps the most useful part of the expense policy feature. This free text area allows the specifics of the policy to be described for display in the expense receipt and customer invoice.

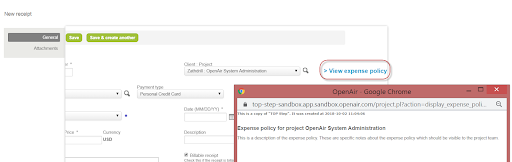

The expense policy information is accessible via a link once the project is selected on the receipt form when entering expenses:

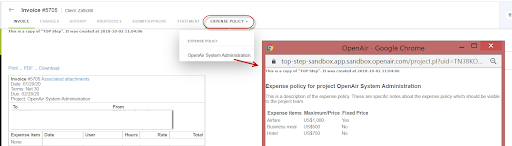

Within invoices, the expense policy appears as a tab that displays the same information as entered on the project properties form:

Caution: Maximum receipt values are interpreted as the maximum amount of a single receipt, not an accumulated amount by expense item type. A typical example is lodging where the bill is itemized by nightly rates but entered as a single receipt for all nights. In the case where a maximum rate is set by the customer, the receipts must be entered on a nightly basis instead of as a total lodging amount.