New Custom Fields Reveal Calculation of Incurred vs. Forecast Revenue Recognition Transactions

Thanks to a recent update, auditing revenue recognition transactions created by the Incurred vs. Forecast revenue recognition rule just became much easier. You can now create custom fields to hold the various information that is used to calculate the amount for each revenue recognition transaction. These fields are populated automatically when OpenAir creates each revenue recognition transaction.

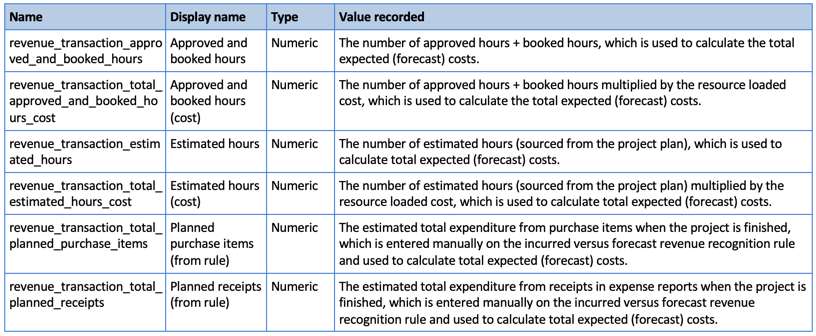

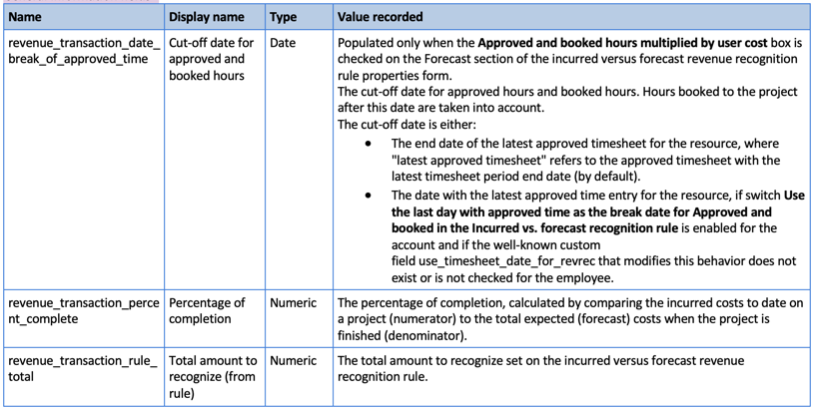

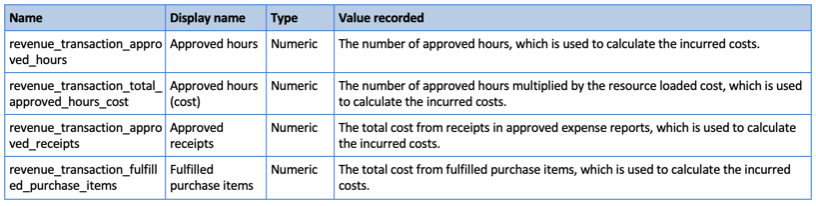

The following tables list the name, suggested display name, type, and a description of the value recorded for each custom field you can create for auditing purposes.

When creating each custom field:

- Under Add a custom field to, select Recognition transaction.

- Under Type of field to add, select the type specified in the following tables.

- Enter the Name exactly as specified in the following tables.

- Enter a Display name The display name may be different than the one suggested in the following tables.

Custom Fields to Create

General information fields

Incurred costs to date calculation details

Expected costs at completion (forecast) calculation details