How to Import Taxes from NetSuite Back to OpenAir

When tax is calculated in NetSuite, it may be beneficial to bring tax amounts back into OpenAir for financial visibility or reporting.

Method 1: Pullback Mapping (not recommended if using credits)

The first method to import tax is to add a pullback mapping to the NetSuite-OpenAir connector. This has the advantage of providing the ability to map back one of several tax amounts that may be available in NetSuite. Caution: this can cause negative balances when applying credits

To add a pullback mapping:

- Navigate to: Administration > NetSuite Connector > Mapping > Invoices

- Add a new Pullback Row

- Choose which NetSuite tax field you want to import and which field to map to in OpenAir

- Save the Mapping

Problem with Credits

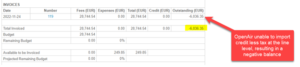

When importing a credit from NetSuite, typically only the full amount (line + tax) is available for import. Therefore, if taxes have been imported, the method above may cause OpenAir to show incorrect negative balances on each invoice line item when viewing outstanding balances.

Method 2: Enable “Import Taxes from NetSuite” (recommended)

The second method is to enable the “Import taxes from NetSuite” feature. When this feature is enabled the tax amount will be imported on invoices and automatically apply the correct amount on credit memos, therefore it is the recommended approach when using credits.

To enable this feature:

1. In NetSuite, navigate to Setup > Company > General Preferences

2. Under Custom Preferences, check the box for “Enable OpenAir Invoice Tax Export” and save

a. NetSuite invoices will now have a field called “OpenAir Invoice Tax Amount”

3. In OpenAir, navigate to: Administration > NetSuite Connector > Mapping > Invoices

4. Click Settings, then check the box for “Import taxes applied to exported invoices”

Note: If amounts are not pulling back, ensure that the NetSuite-OpenAir user has permission to access invoices and credits in NetSuite

For additional information, search “NetSuite Tax” in the OpenAir Help Center or view SuiteAnswers cases 40016 and 31262.