Are Your Expense Item Billing Rules Being Capped Accurately?

If you are adding caps to your expense item billing rules, chances are the cap isn’t being applied quite the way you expect. Normally, the system will apply the cap to the nearest hundredth, but it is based on quantity – not money.

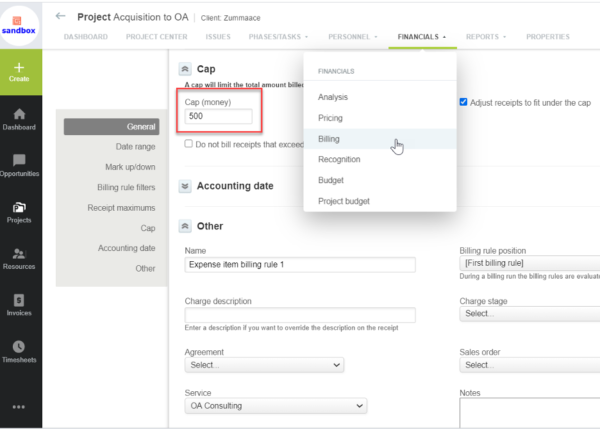

For example, if an expense-billing rule is capped at $500, and $300 has already been billed, the amount available before the cap is reached is $200.

If a receipt for $201 is processed by the billing rule next, and the box “Adjust receipts to fit under the cap” is checked, the rule will cap it at $200 and the $1 will be split out as a second receipt. Without the box checked, the cap will actually be exceeded by $1. It may be a small amount, but is it worth the risk of potentially delaying invoice payment?